Khan warned that enabling protectionism for tech monopolies wouldn’t just hurt all of us, it would hurt them too. Now they’re getting wiped out.

U.S. tech stocks are plummeting as China looks to be exposing American companies involved in AI as wildly overvalued. It’s a predictable consequence of how the American government has approached Silicon Valley and vice versa. This isn’t the kind of thing we normally cover, but we don’t quite trust the U.S. media to tell this story accurately.

Anybody following it casually has seen how it went down. U.S. tech companies, with the support of the federal government (and the Pentagon), built up a dominant global position through genuine innovation. Microsoft, Facebook, Apple, Google, and Amazon reshaped the world. Microsoft, one of the first major companies to rise, tried to put a halt to that innovation by buying up and/or crushing its competitors, but the U.S. sued it in 1998 for violating antitrust laws. The Bush administration settled the case, backing off the effort to break them up. What followed was a bipartisan embrace of Big Tech; the Bush and Obama eras saw unbridled growth and mergers. As tech companies saw smaller firms innovating, they would buy the company, kill it, and absorb some of its staff.

An anti-monopoly movement started bubbling up, leading to lawsuits against Facebook, Amazon, Google, and Apple over the past decade. Lina Khan, as chair of the Federal Trade Commission under former President Joe Biden, became a folk hero as she warned that greed and consolidation weren’t just harming consumers and workers, but that the sclerotic companies themselves would eventually suffer from the lack of competition. “Our history shows that maintaining open, fair, and competitive markets, especially at technological inflection points, is a key way to ensure America benefits from the innovation these tools may catalyze,” Khan said in 2023.

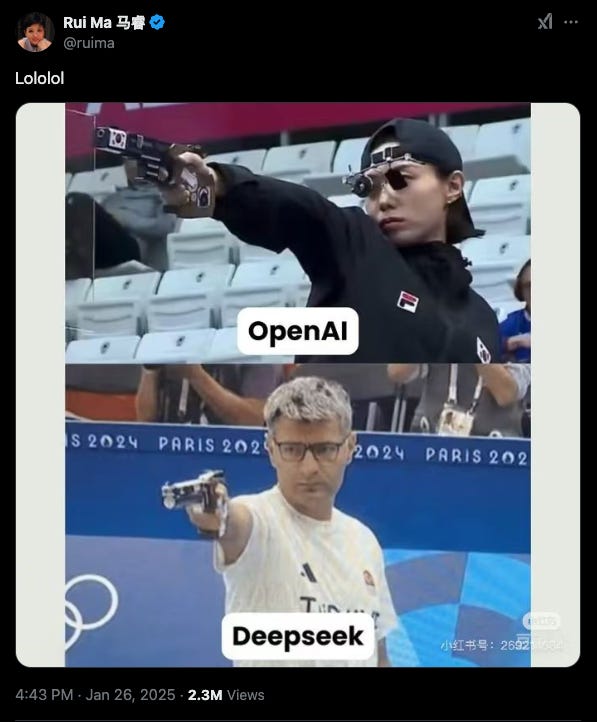

Now it’s become clear that the moat the U.S. built to protect its companies from domestic competition actually created the conditions that allowed them to atrophy. They got fat and happy inside their castles. Their business pivoted from technological innovation to performing alchemy with spreadsheets, turning made-up metrics into dollar valuations detached from reality. Now DeepSeek has exposed the scam. With a tiny fraction of the resources, and without access to the full panoply of U.S. chip technology, the Chinese company DeepSeek has pantsed Silicon Valley. The U.S. company OpenAI began as a nonprofit dedicated to making AI widely available, as its name suggests. Its top guy, Sam Altman, managed to transition it to a for-profit and close it off.

We have an FAQ on the details of DeepSeek below.

Meanwhile here in the United States, Trump is celebrating a (possibly exaggerated) $500 billion investment in Texas to fuel AI computer power that appears to be made obsolete—or much less relevant—thanks to DeepSeek’s innovation. And Trump is stacking his administration with crypto bros, tech moguls refusing to divest, and even launched his own scam meme coin. Trump’s senior tech advisers like Elon Musk meanwhile have extensive commercial ties directly with China. You don’t have to squint too hard to see which of these countries is going to win this competition.

The social contract struck between the U.S. government and Silicon Valley—which the American people became an involuntary party to—was straightforward: We will let a handful of tech bros become unfathomably wealthy and in exchange they will build a tech industry that keeps America globally dominant. Instead, the tech bros broke the bargain. They took the money, but instead of continuing to innovate and compete, built monopolies to keep out competition—even getting the help of the U.S. national security state to block Chinese access to our tech. But they couldn’t keep out of the competition forever. Lina Khan was right. And now here we are.

The downstream effects will be profound if the trajectory of a wealth transfer from the U.S. to China continues apace. It’s common to say that most people don’t own individual stocks, but that understates the exposure we all have to this scam. It’s in our IRAs or 401ks and the rise of those stocks made up nearly all of the growth of the stock market in recent years. And if China increasingly becomes the place to go work if you’re an ambitious researcher or developer, it’s not hard to see where that leads.

Below is an explainer on DeepSeek we asked our correspondent Waqas Ahmed to put together.

Q: What is DeepSeek and why is it causing a stock meltdown? A: The Chinese company DeepSeek has released an AI model that is as good as any of its American counterparts and has made it open source. This has fundamentally changed the economics and politics of the rapidly emerging AI industry, which has so far been led by an oligopoly of American tech companies trying to position Large Language Models (LLMs) as the defining technological breakthrough of this century, and themselves as the custodians of its secret sauce. There’s a lot of talk about DeepSeek costing only about $6 million to build, although that figure does not include research and development. And despite export controls, DeepSeek did manage to exploit a non-trivial number of the high-tech chips we were trying to keep from them. Yet it’s still a massive shock to the U.S. industry. Q: What are LLMs and how did they take off? A: A 2017 paper titled “Attention is all you need” was a turning point in the AI industry. The paper described a method of creating a machine learning model that could produce human-like text with unprecedented accuracy and scale using an architecture called “transformers.” These “transformers” considerably improved a class of models called Large Language Models (LLMs). LLMs use massive amounts of text—books, articles, emails, recipes, faqs, everything—to create internal mathematical representations of relationships between billions of words and phrases—or more accurately, between combinations of tokens that are found in a natural human language. Before 2017, LLMs were not very useful, but “transformers” changed that. By processing large amounts of text using the transformer architecture, these models could now “learn” what words mean in different contexts, and detect nuances computers had never been able to before, allowing these models to output extremely relevant text in response to a user prompt or question. Q: How did the AI hype start? A: OpenAI became the first American company to demonstrate that if you take a snapshot of the whole known internet and all digitized books in existence without worrying too much about copyright law, you can create a model so good that its output would be almost indistinguishable from that of a DC bureaucrat with mediocre intelligence. However, OpenAI showed, its model could be trained to have expertise in different domains and could give in-depth answers to very specific questions. Its model passed coding exams, the bar exam, and graduated business school. The results were so shocking that OpenAI went out and claimed it was worth a gazillion dollars and that the future of humanity depended on it. Q: What is the current state of the AI industry? A: OpenAI, partially owned by Microsoft, was the first to release a major LLM product, ChatGPT in November 2022. Soon after, Meta released its own model, LLaMa, and Google released Gemini. All three companies had massive amounts of text to train their models on, but an LLM needs another crucial ingredient: computing power to process that text and then to generate responses to user queries. The leading company that makes the computing machines is Nvidia, whose stocks grew exponentially as response when OpenAI/Microsoft, Google, and Meta led LLM wars ensued. The computing machines are called GPUs—Graphic Processing Units. They had originally been invented to process computer graphics for games, such as 3D rendering. Later they became popular because their parallel processing capabilities made them ideally suited for cryptocurrency mining. Now, it turns out, they are also great at AI data processing for similar reasons. Nvidia has basically been riding waves of booms as different markets discover new uses for its product. Over the past few years, Meta, Google, Microsoft, and OpenAI have managed to hoard hundreds of thousands of the most advanced GPUs, and get preferential treatment from both Nvidia and its supplier, the world primary manufacturer of semiconductors, TSMC. The American tech industry has been taking significant steps to align itself around AI. Companies have been acquiring startups, recruiting top AI researchers, and pouring resources into developing their proprietary primary AI models (called foundational models), creating a flow of investment into AI and related technologies, such as cloud computing, advanced chip manufacturing, and data infrastructure. This is all a bid to secure dominance in what they claim is the next frontier of technological innovation. Q: How is China involved? A: As a part of its larger effort to contain China, the U.S. government has been on a mission of stopping Chinese companies from becoming leaders in different areas of technology. It has done so by wielding control over global supply chains and protecting American tech companies from competition in the process. The U.S. blocked Huawei’s entry into the United States just as it was overtaking Apple to become the second biggest smartphone manufacturer in the world; it stopped European countries from installing Huawei manufactured 5G infrastructure when it was clearly more economical; and most recently, it passed legislation banning TikTok, a Chinese social media app that had become massively popular in United States and whose recommendation algorithm no American social media app had been able to outperform. The U.S. claim that Huawei and other Chinese tech companies are inextricably linked to China’s geopolitical strategy and put Western companies and people at heightened risk of surveillance and corporate espionage is, of course, grounded in reality. DeepSeek isn’t shy about how much data it collects on its platform, including even your keystrokes: We collect certain device and network connection information when you access the Service. This information includes your device model, operating system, keystroke patterns or rhythms, IP address, and system language. We also collect service-related, diagnostic, and performance information, including crash reports and performance logs. We automatically assign you a device ID and user ID. Where you log-in from multiple devices, we use information such as your device ID and user ID to identify your activity across devices to give you a seamless log-in experience and for security purposes. However, because DeepSeek is open source and can run locally on a separate device, Chairman Xi Jinping’s prying eyes can be shielded. Maintaining global technological dominance is one of the key concerns U.S. policymakers have repeatedly cited, and have identified AI as a crucial technology in maintaining that dominance. In 2018, when the U.S. government was in the process of banning Huawei, it realized that it would need to do the same with downstream technologies like semiconductor chips, the main component used in CPUs and GPUs. The severe chip shortage due to global supply chain disruptions during Covid-19 showed that advanced chips are a global supply chain bottleneck and a scarce resource. By 2022 the Biden administration had put comprehensive sanctions on China, stopping the export of these chips to the country and preventing Chinese AI companies from accessing the latest and most efficient GPUs. At the same time, it passed the CHIPS act, subsidizing national semiconductor manufacturing with over $50 billion. Q: Why is everyone suddenly so into AI? A: The over-the-top marketing and snake oil salesman level of pushing by the U.S. AI industry has caused somewhat of a freakout among less technically literate government policymakers. Many industry insiders claimed that advances in LLMs could soon lead to creation of Artificial General Intelligence (AGI), basically a computer that thinks like a human being and is good at many different tasks. Some have already sounded the alarm that it can become evil and self-aware. But even its detractors have agreed LLMs are a game-changing technology that will fundamentally change how we interact with computers. Q: Why are tech bros so mad? Big tech companies have also been telling the government and investors that building AI is very very expensive. In his first week in office, U.S. President Donald Trump has announced $500 billion in private sector investment in AI under a project called Stargate—a collaboration between OpenAI, Softbank, and Oracle. In the past OpenAI founder Sam Altman has claimed that he would need as much as $7 trillion to create his dream AI and was raising investment using that target. For context, no man in the entire history of the world has ever spent that amount of money on a single thing. But the underlying message seems to be: this is a magical technology and a force more powerful than any the world has ever seen, we need astronomical amounts of money to build it and we need the protection of the U.S. government while doing so. Then came a tiny Chinese company that popped that bubble with its side project. It used $5.5 million worth of computational power to do this, using only 2,048 Nvidia H800 GPUs that the Chinese company had because it could not buy the superior H100 or A100 GPUs that American companies are gathering in hundreds of thousands. For context, Meta AI had set the target of owning a cluster of 600,000 H100 GPUs by the end of 2024. Elon Musk has 100,000 GPUs, whereas OpenAI trained its GPT-4 model on approximately 25,000 A100 GPUs. Meanwhile, DeepSeek was founded by the Chinese hedge fund manager High Flyer that wanted to put its cluster of, according to Chinese media, 10,000 H800 GPUs to good use. DeepSeek, according to the lore, hired a really young team and pushed them to innovate and make the most out of their limited hardware. They released the DeepSeek-V3 model last month, a model that outperforms OpenAI GPT-4 and all other models in the industry in most benchmarks. There isn’t any significant development in the basic technology, they just use hardware efficiently and train their model better. Tech bros are salty because this makes them look bad. What further complicates matters is that DeepSeek has released its model and training methods as open source software, meaning anyone can see how they made their model and replicate the process. It also means that users can install DeepSeek models on their own machines and run them on their own GPUs, where they seem to be performing very well. Q: How are the tech bros reacting? A: While there has been a significant vibe shift towards “it’s so over,” some still maintain that “we are so back” and this is “AI’s Sputnik moment.” Others have not been so magnanimous. “deepseek is a ccp state psyop + economic warfare to make american ai unprofitable. They are faking the cost was low to justify setting price low and hoping everyone switches to it, damage AI competitiveness in the US, dont take the bait,” tweeted Neal Khosla, investor Vinod Khosla’s son. Khosla Ventures has raised more than $400 million for OpenAI and is one of the biggest investors in the company. “DeepSeek is a wake up call for America,” said Alexandr Wang, founder of AI company Scale AI, and someone who has more notably accused DeepSeek of hiding a secret stash of 50,000 H100 GPUs. “The accusations/obsessions over DeepSeek using H100 sound like a rich kids team got outplayed by a poor kids team, who weren't even allowed shoes,” tweeted Jen Zhu, an AI investor, “and now the rich kids are demanding an investigation into whether shoes were used instead of training harder to improve themselves.” Q: Why is the stock market plummeting? A: While DeepSeek v3 has been out for almost a month now, the news is beginning to hit the market only now. Nvidia stocks were down almost 15% pre-market on Monday, losing approximately $420 billion from its market capitalization and triggering a bloodbath across semiconductor stocks that could wipe $1 trillion off the stock market in a single day. When it was released late December, Andrej Karpathy, an important scientist in the field, commented upon its surprising efficiency, but the repercussions of an unknown Chinese company releasing an open-source foundational model only took off once Silicon Valley began to try DeepSeek on their personal computers and DeepSeek climbed to the number one app. Ironically, tech bros freaking out and generating previously unseen levels of cope is contributing to DeepSeek’s virality.